income tax bracket malaysia

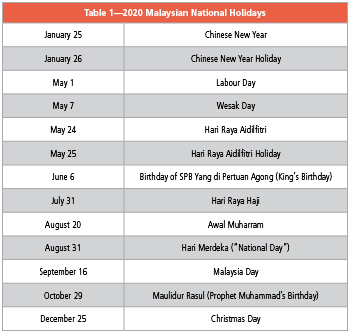

This booklet also incorporates in coloured italics the 2023. As of writing the Malaysian.

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

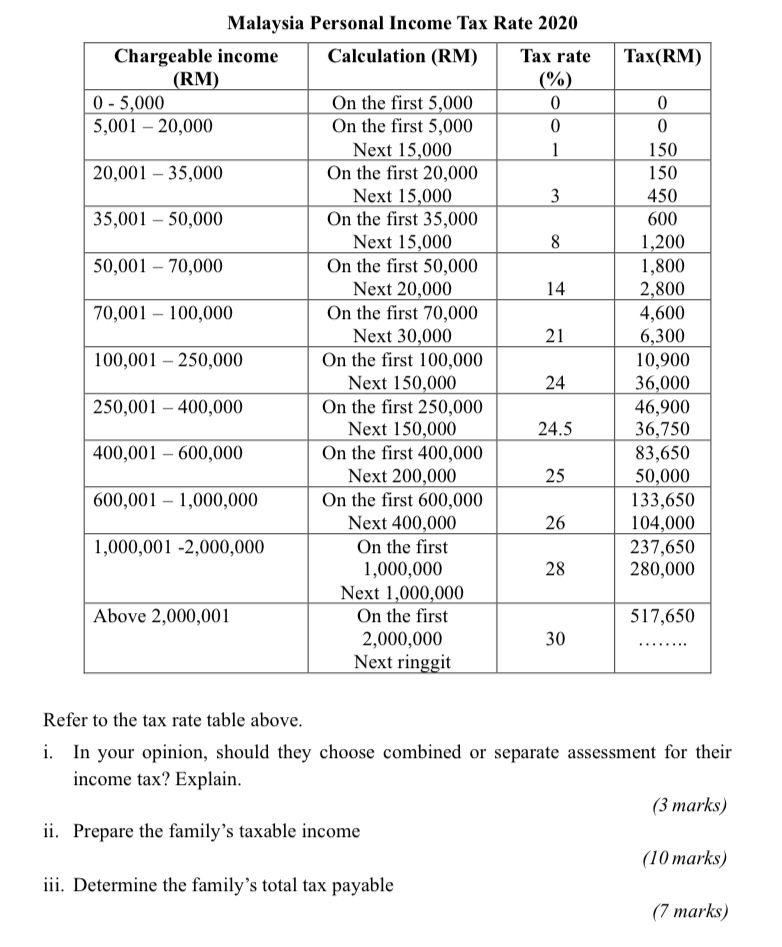

On the First 5000 Next 15000.

. Up to RM3000 for. Calculations RM Rate. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. A non-citizen receiving a monthly salary of not less than. This is based on the.

Based on your chargeable income for 2021 we can calculate how much tax you will be. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Top 20 T20 Middle 40 M40 and Bottom 40 B40.

However there are exceptions for certain. On the First 2500. Tax RM 0 2500.

Chargeable income RM20000 Total tax amount RM150 Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to. 13 rows Malaysia Residents Income Tax Tables in 2020. On subsequent chargeable income 24.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Calculations RM Rate TaxRM 0 - 5000. Mengenakan income tax malaysia 2022 kepada kalangan yang tinggal dan bermastautin di Malaysia tetapi menerima gaji dan pendapatan dari sumber asing luar negara.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. These are called tax reliefs including medical expenses educational fees and childcare expenses. A qualified person defined who is a.

Last updated 24 March 2022 Malaysians are categorised into three different income groups. Malaysia Residents Income Tax Tables in 2022. There are incomes exempted from tax.

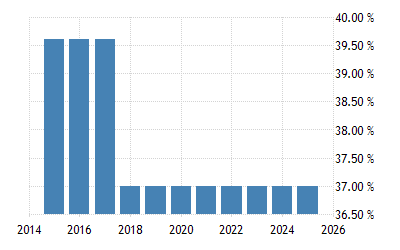

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. Resident company with paid-up capital above RM25 million at the beginning of the basis.

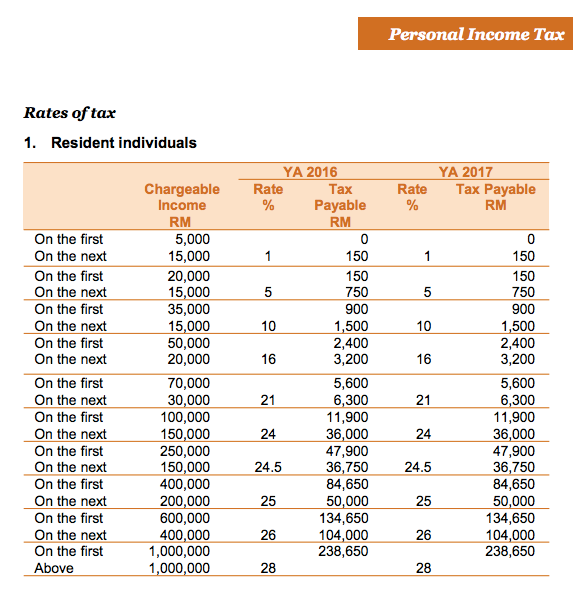

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. 13 rows 28.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. It should be noted that this takes into account all your income and not only your. An effective petroleum income tax rate of 25 applies on income from.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 for 5 consecutive YAs. Joint Assessment Wife Husband-350.

This enables you to drop down a tax bracket lower your. RM9000 for individuals. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

On the First 20000 Next. On the First 5000. FYI every household in Malaysia will be grouped in B40 M40 or T20 depending on their monthly income.

Year Of Assessment 2001 - 2008 RM Year Of Assessment 2009 Onwards RM a. On first RM500000 chargeable income 17. Separate Assessment Wife Husband-350 350-400 400.

This is so that the gahmen can monitor create a financial.

Personal Tax Archives Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Entity Country Legal Form Activity Income Before Taxes Income Tax Rate Dividend Withholding Tax Rate Net Dividend Received By Parent A Bahrain Branch Course Hero

What You Need To Know About Payroll In Malaysia

Denmark Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

How To Calculate Foreigner S Income Tax In China China Admissions

Corporate Tax Rates Around The World Tax Foundation

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Erwan Plans To Buy A House He Has Two Options To Chegg Com

About Representative Ocasio Cortez S 70 Tax Rates

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Income Tax Malaysia 2019 Calculator Madalynngwf

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Tax Guide For Expats In Malaysia Expatgo

Malaysian Personal Income Tax Pit 1 Asean Business News

What Is The Difference Between The Statutory And Effective Tax Rate

0 Response to "income tax bracket malaysia"

Post a Comment